Start a New Business On Diwali Festival With 50% Offer-

Thinking of starting a new business, you have brought the best offer for you, If you have a csc / online center or you have a shop, then this business is beneficial for you.

Going to tell you about the service right now -

Aadhaar Enabled Payment System (aeps)-

In this service you can withdraw money from Aadhaar linked bank account with Aadhaar card.

AADHAAR Enabled Payment System provides basic financial services (cash deposit, balance enquiry, cash withdrawal and remittance) at low cost access devices (called MicroATMs) maintained at Business correspondents in an inter-operable way.

AADHAAR enabled basic types of banking transactions are:

Cash Withdrawal

AADHAAR to AADHAAR Funds Transfer

Balance Enquiry

Gateway Authentication Service

Inputs required for a bank or a Banking Correspondent to do a transaction under this scenario are:-

IIN (Identifying the Bank to which the customer is associated)

AADHAAR Number

Fingerprint captured during their enrollment.

This powers the banking agent to operate on the field, doing transactions for their customer in an effective manner. Another system AADHAAR Payment Bridge Solution (APBS) is be used to

EBT Credit disbursements based on UID number.

To sub-serve the goal of Government of India (GOI) and Reserve Bank of India (RBI) in furthering Financial Inclusion by way of processing government disbursement using AADHAAR number.

To support various Schemes like NREGA, Social Security Pension, Handicapped Old Age Pension etc. of any Central or State Government bodies, to send financial details to the beneficiary using AADHAAR number. Nelito has been in the forefront in providing banks with ABPS and AEPS systems. It has already gone live with 12 banks for these projects and preparing more banks for the platform.

Bharat Bill Payment System -

Bharat Bill Payment System (BBPS) is an integrated bill payment system in India offering interoperable and accessible bill payment service to customers through a network of agents of registered member as Agent Institutions (AI),[1] enabling multiple payment modes, and providing instant confirmation of payment.

National Payments Corporation of India (NPCI) functions as the authorised Bharat Bill Payment Central Unit (BBPCU), which will be responsible for setting business standards, rules and procedures for technical and business requirements for all the participants. NPCI, as the BBPCU, will also undertake clearing and settlement activities related to transactions routed through BBPS. Existing bill aggregators and banks are envisaged to work as Operating Units to provide an interoperable bill payment system irrespective of which unit has on-boarded a particular biller. Payments may be made through the BBPS using cash, transfer cheques, and electronic modes.

Mobile Recharge

Paydeer is a leading pre-paid mobile recharge website in INDIA- On Paydeer B2B Retailers and users can recharge prepaid mobile online. Paydeer is the safest way to prepaid recharge for all Indian providers. Apart from GSM phone recharge, Online recharge is also available for CDMA prepaid mobile phones. Paydeer has tied up with all major telecom service providers to bring convenience to you. We offer recharge for Airtel, Vodafone Idea, Reliance-Jio, telenor, MTNL, BSNL and more.

Why use my recharge B2b Wallet for Online Mobile Recharges? Letsgo retailer Wallet gives you the ultimate freedom to be able to do your prepaid mobile recharge anytime and from anywhere. Whether you are travelling, on a holiday or at work, recharge as and when you wish.

Paydeer Recharge makes the

recharge of prepaid DTH account quick and comfortable. You do not have to visit the retail outlets for getting your online DTH account recharged. Online DTH Recharge through Letsgo Recharge facilitates recharging of prepaid DTH account for operators like Dish TV, Big TV, Sun Direct, Videocon D2H and Tata Sky.

Paydeer in makes for a very convenient way to recharge all DTH in INDIA. DTH allows consumers to stay directly connected with the broadcaster. Letsgo is simple and easy offer its exciting range of DTH recharge services for various DTH Services. Through our website users can recharge their digital TV anytime and from anywhere in the world. What's more, the website also allows you to manage your B2B wallet.

You can recharge it at the comfort of your home or office with few clicks of mouse. All you need to have is a computer with internet connection and online recharge of your prepaid DTH account is just few clicks away. Just login, select the operator, fill the recharge denomination, DTH account number and proceed further with recharge. It is as simple as ever.

Pos & Mpos ( Micro ATM )

With Paydeer PoS, merchants can now accept payments from several modes other than cash. The device is easy to use and empower merchants to go cashless! Sell anytime, anywhere Offer multiple payment modes Up-sell to customers using credit/debit cards Reduce Cash Handling/ Management Provide card-on-delivery option at customers’ home No more fake and counterfeit notes Automatic settlements for all types of payments Eliminate cash handling and cash counting errors Also offer Micro ATM services to the customers Give a bouquet of other Let’sGo services viz. Recharges,DMR, Bill Payments etc.

Pos Machine meant to be a device that is used by a million Business Correspondents (BC) to deliver basic banking services. The platform will enable Business Correspondents (who could be a local kirana shop owner and will act as ‘micro ATM’) to conduct instant transactions.

The micro platform will enable function through low cost devices (paydeer Pos Machine) that will be connected to banks across the country. This would enable a person to instantly deposit or withdraw funds regardless of the bank associated with a particular BC. This device will be based on a mobile phone connection and would be made available at every BC. Customers would just have to get their identity authenticated and withdraw or put money into their bank accounts. This money will come from the cash drawer of the BC. Essentially, BCs will act as bank for the customers and all they need to do is verify the authenticity of customer using customers’ UID. The basic transaction types, to be supported by Let'sGo Pos Machine, are Deposit, Withdrawal, Fund transfer and Balance enquiry.

Vehicle Finance

Indian financial services sector is set to dominate the Indian economy over the next few decades. Banking, capital markets, insurance and asset management are all set to significantly grow in the next few years. Learning from global financial disturbances and evolving financial technologies, the Industry leaders and the regulators are working on building a sustainable banking and para banking environment in India. Foreign institutional investors are back in business and keen to invest in India for the longer term. Large players in fund management industry are exploring investment opportunities and even setting up their business presence in India.

The Indian financial services sector is operating in a fast-evolving and dynamic regulatory and tax landscape with an ever growing demand for transparency and efficiency. This makes it extremely important for the industry players or the new entrants to understand the tax and regulatory framework which could have an impact on their business goals.

Let'sGo has the largest financial services tax and regulatory services team in the country with a dedicated team of 170+ professionals lead by 28+ partners who have strong sector credentials. We are actively advising clients on the entire fund / deal cycle along with X-LOS team across the country, which can customise the offerings across assurance, tax and deals.

With years of experience and deep expertise in the Indian

financial services industry and our integrated team structure, we have the ability to cater to almost every need in the tax and regulatory space of our clients in this industry.

Vehicle Insurance

Vehicle Insurance Paydeer- Vehicle insurance (also known as car insurance, motor insurance or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region. If a vehicle is declared a total loss and the vehicle’s market value is less than the amount that is still owed to the bank that is financing the vehicle, GAP insurance may cover the difference. Not all auto insurance policies include GAP insurance.

Vehicle Insurance Let’sgo -

Vehicle insurance (also known as car insurance, motor insurance or auto insurance) is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

History – Vehicle Insurance Let’sgo – Widespread use of the motor car began after the First World War in urban areas. Cars were relatively fast and dangerous by that stage, yet there was still no compulsory form of car insurance anywhere in the world. This meant that injured victims would seldom get any compensation in an accident, and drivers often faced considerable costs for damage to their car and property.

A compulsory car insurance scheme was first introduced in the United Kingdom with the Road Traffic Act 1930. This ensured that all vehicle owners and drivers had to be insured for their liability for injury or death to third parties whilst their vehicle was being used on a public road. Germany enacted similar legislation in 1939 called the “Act on.

Prepaid Card

Paydeer PRE-PAID CARDS

How to get it:-

- Provide full KYC (Know Your Customer) information to open new account

- Apply for Wallet/ Pre-paid Card

- Get a MPIN / PIN

Service Activation:

Load money (subject to regulatory limits) using branch, or internet banking

Bank A/c

All Cards

1-2 days for card

5-7 minutes for wallet

What is required for Transaction:

Smartphone or internet

Use MPIN

Self-service and/or Assisted mode

Transaction Cost:

On loading the pre-paid card, Customer may pay service charges for transaction or fixed fee, upfront + each transaction.

Loading wallets is mostly free.

Merchant is charged fee 0.50% to 2.50 %

Cash out is charged to customer as fixed fee or 1% to 2.5% of value of transaction. Only from Cards

Disclaimer: The transaction costs are based on available information and may vary based on banks.

Services Offered:

Balance Enquiry

Passbook/ Transaction history

Add money

Bank A/c

All Cards

Accept Money

Pay money

Another wallet (mobile no.) with same provider

Pay merchant

Bar Code reader

Cash-Out (Cash withdrawal)

Touch and Pay

Manage Profile

Notifications

Funds Transfer limit:

For Users

Rs 1,00,000/- for Users

For Merchants

Self-Declared - Rs 50,000/ month

With KYC – Rs 1,00,000/- month

Disclaimer: The funds transfer limits are based on available information and may vary based on banks.

Service Available from no. of operators:

All leading Banks

Non-operable

Cash-out with limits only for VISA/Mastercard linked wallets/ cards.

Domestic Money Transfer (DMT)

Paydeer are providing Domestic Money Transfer (DMT) services in partnership with banking institutions. Our

Money Transfer system is outcome of detailed study and continuous up-gradation for over 2 years. Our Money Transfer platform is one of the very few in India which supports transactions through Android app.

Some features of Paydeer Domestic Money Transfer –

Non-KYC Customer transaction Limit: Rs 75,000/- per month (best in the industry)

Instant settlement from wallet after successful transaction

Automatic refunds in case of failures (OTP based for enhanced security)

Feature of account verification for most of the banks

Send up to 25000 in one transaction. No need to do multiple transactions of Rs 5000 for higher amounts

Automatic reconciliation with various banks for pending transactions

Support for both IMPS and NEFT transactions.

App Notifications/Desktop Notifications/URL Callback whenever any transaction is refunded

High success ratio

Support for bill payments of credit cards using NEFT

Currently we do not provide APIs of Money Transfer. We provide retailership, distributorship, Master distributorship, State Head, and invite franchisee partner to expand our business. We also provide white label solutions for B2B Money Transfer business. Please use buttons below to register/contact us for Domestic Money Transfer services.

Pan Card

Paydeer Pen Card Servises

We Are Providing UTI Authorized PAN PSA Portal PAN India. paydeer Is An Organization With An Aim Of Providing Better Services And Technical Solutions To Our

PAN PSA.

PAN card is a ten-digit alpha-numeric identifier and acts as an identification for Indian nationals. It is an essential document for those paying taxes. And, GST Consultants And Advisors is involved in providing all sorts of PAN card related services. With our services, we coordinate with clients, assist them in filling and filing document and completing other legal

Pan Card Let'sGo has been authorized to apply

PAN CARD across India through our retail network. Retailer will able to make online application of New PAN Card and Correction Duplicate. A great opportunity for Retailers to become authorized agent for PAN Card. About Pan Card • Permanent Account Number (PAN) is a ten – digit alphanumeric issued by Income tax Dept., • Any person, who intends to .

PAN Card (

Permanent Account Number) is provided by Income Tax Department to every Income Tax payers. The PAN is mandatory for a majority of financial transactions such as opening a bank account, receiving taxable salary or professional fees, purchase of foreign currency, bank deposits above Rs. 50,000, purchase and sale of immovable properties, vehicles etc. Quoting the PAN is mandatory when filing Income Tax returns, tax deduction at source, or any other communication with Income Tax Department.

Contact Us

Paydeer

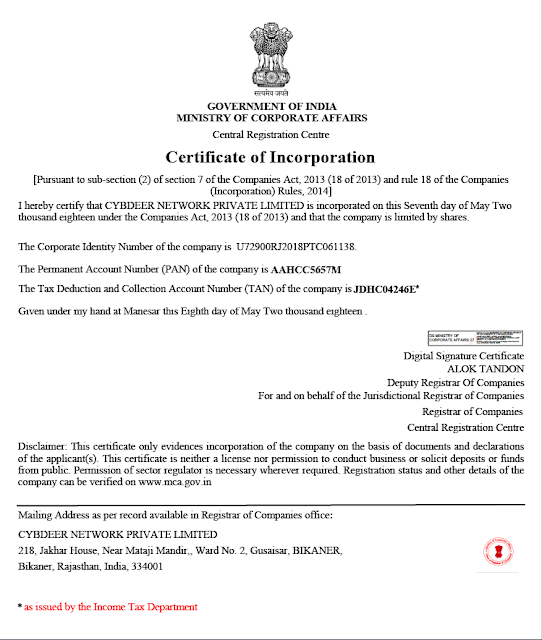

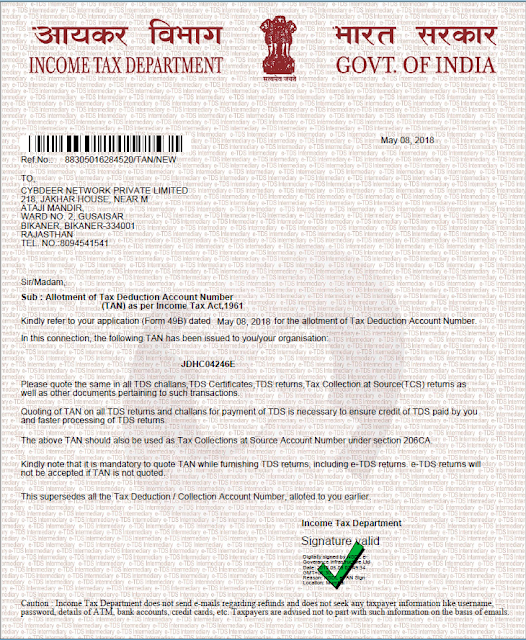

a unit of

CYBDEER NETWORK PVT. LTD.

First floor c-10 sector number 9 chitrakoot Marg Vaishali Nagar Jaipur Rajasthan

Jaipur - 302021, Rajasthan, India

Phone: 8448441008, 8448448515. 74282-74282

Paydeer accepts PAN applications on behalf of UTI. PAN applications can be obtained from TIN-FCs, PAN centers or any other vendors providing such forms or can freely download the same from this website.

Paydeer accepts PAN applications on behalf of UTI. PAN applications can be obtained from TIN-FCs, PAN centers or any other vendors providing such forms or can freely download the same from this website. A duly filled and signed PAN application form then has to be submitted along with the required supporting documents at the center.

A duly filled and signed PAN application form then has to be submitted along with the required supporting documents at the center. The applicant needs to submit the primary documents with the application form, namely, proof of identity (POI) and proof of address (POA).

The applicant needs to submit the primary documents with the application form, namely, proof of identity (POI) and proof of address (POA). Overwriting should be avoided to reduce chances of any errors.

Overwriting should be avoided to reduce chances of any errors. Putting any staple pins on the photograph that may partially tear/ damage it, should be avoided.

Putting any staple pins on the photograph that may partially tear/ damage it, should be avoided. Signature should be clear, done properly and within the box provided.

Signature should be clear, done properly and within the box provided. Any details including the date, designation or rank etc. should be avoided to be written alongside the signature in the box.

Any details including the date, designation or rank etc. should be avoided to be written alongside the signature in the box. Be precise and specific while filling in detail like, for example, don’t mention husband’s name in the father’s name column.

Be precise and specific while filling in detail like, for example, don’t mention husband’s name in the father’s name column. Revise the form after filling for all the information entered must be 100% accurate

Revise the form after filling for all the information entered must be 100% accurate